Pocket Option Predictions: An In-Depth Analysis

In the world of online trading, making precise predictions is crucial for success. Pocket Option predictions прогнозы на Pocket Option are essential tools that traders use to navigate the fluctuating markets. As technology advances, the tools and methods available to make accurate predictions are becoming more sophisticated, enabling traders to adapt and refine their strategies.

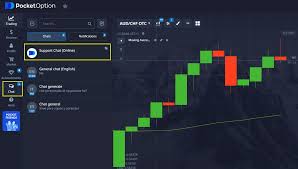

Understanding Pocket Option

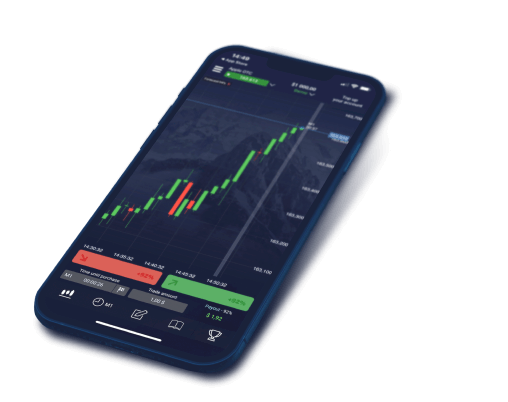

Pocket Option is a well-known trading platform that offers a variety of financial instruments, including forex, commodities, stocks, and cryptocurrencies. The platform is designed to cater both to novice traders and seasoned professionals, providing them with the necessary tools to conduct technical and fundamental analyses. Among these tools, prediction strategies play a crucial role in determining the traders’ success rate.

Types of Predictions in Pocket Option

There are several types of predictions that traders can utilize on the Pocket Option platform:

Technical Analysis Predictions

Technical analysis involves studying historical price movements and utilizing various indicators to predict future market behavior. Traders often employ tools like moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to make informed predictions. By observing patterns and trends, traders can identify potential support and resistance levels, which in turn helps them decide when to enter or exit trades.

Fundamental Analysis Predictions

Fundamental analysis focuses on economic indicators, geopolitical events, and market news that can impact prices. Factors such as interest rates, unemployment reports, and earnings announcements provide valuable insights into market sentiment. Traders who incorporate fundamental analysis into their predictions often gain a deeper understanding of the market dynamics, enabling them to make more educated trading decisions.

Sentiment Analysis Predictions

Sentiment analysis looks at the overall market mood, usually gauged through social media and news outlets. Understanding how other traders feel about a particular asset can provide additional context for making predictions. This form of analysis often complements both technical and fundamental strategies, as market sentiment can significantly influence price movements.

Making Accurate Predictions

While making predictions may seem straightforward, it’s essential to acknowledge the inherent risks and uncertainties in trading. Here are several tips for enhancing your prediction accuracy:

1. Stay Informed

Keep abreast of the latest news and trends in the financial markets. A well-informed trader is better equipped to make sound predictions and adapt to market changes.

2. Diversify Your Strategies

Instead of relying on a single prediction method, consider using a combination of technical, fundamental, and sentiment analysis. A diversified approach will provide a more comprehensive understanding of the market.

3. Backtest Your Predictions

Before committing real money, backtest your prediction strategies using historical data. This can help you identify potential weaknesses and refine your methods.

4. Use Risk Management Techniques

Even the most accurate predictions can fail at times. Implement risk management techniques to protect your capital, such as setting stop-loss orders and managing your position sizes.

Common Mistakes to Avoid

Making predictions in Pocket Option can be a rewarding experience, but certain pitfalls may lead to losses if not recognized and avoided:

1. Overtrading

Traders may be tempted to enter multiple trades in a short span, believing they can predict every market movement. This can lead to poor decisions and increased losses.

2. Ignoring Market Conditions

Market conditions can change rapidly. Failing to consider the current context when making predictions can result in severe misunderstandings of price action.

3. Relying Solely on One Indicator

Many traders make the mistake of relying on one technical indicator without confirming their predictions with additional tools or analysis. This can result in misleading signals and poor choices.

4. Emotional Trading

Emotions play a significant role in trading outcomes. Decisions based on fear or greed rather than sound analysis can lead to costly mistakes. It’s crucial to keep emotions in check and stick to a planned strategy.

The Future of Trading Predictions

The world of trading is constantly evolving. With the advent of artificial intelligence and machine learning, future predictions may become even more precise. These technologies analyze vast amounts of data and offer insights that human analysts may overlook. As these tools become more accessible, traders who embrace technology will likely gain a competitive edge.

Conclusion

Pocket Option predictions serve as a vital component of successful trading strategies. By blending various prediction methods, staying informed, and practicing sound risk management, traders can enhance their chances of success. While the future of trading predictions may be uncertain, one thing is clear: continuous learning and adaptation are essential in this ever-changing market landscape.